maine tax rates for retirees

If you receive retirement income from a pension IRA or a 401k then you will be required to pay taxes as high as 715. Download a sample explanation Form 1099-R and the information reported on it.

Maine Estate Tax Everything You Need To Know Smartasset

For deaths in 2020 the estate tax in maine applies to taxable estates with a value over 58 million.

. 10 on the next 3 million. California will tax you at 8 as of 2021 on income over 46394. Ad Compare Your 2022 Tax Bracket vs.

Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes. Property tax exemption for seniors 65 and older or surviving spouses 50 of first 200000 in actual value exempt No estate or inheritance tax. Your average tax rate is 1198 and your marginal tax rate is 22.

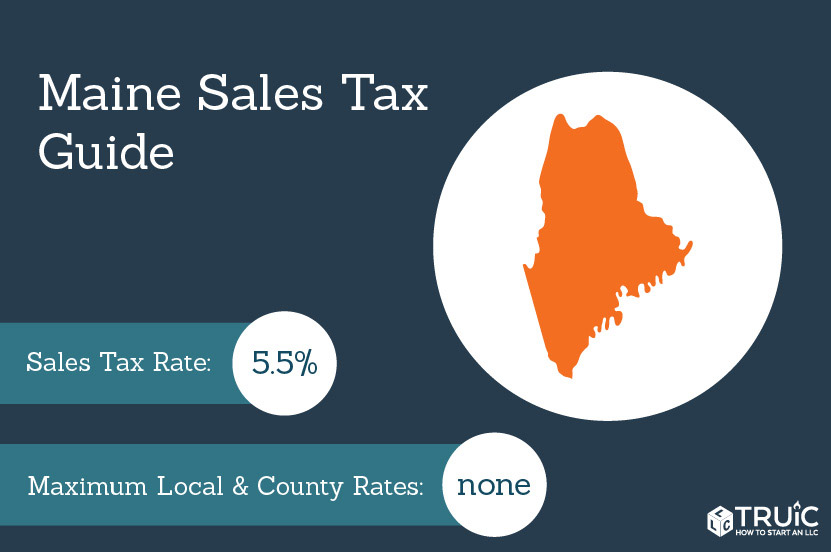

Your 2021 Tax Bracket to See Whats Been Adjusted. However Maines sales tax rate is considerably low at 55. Some states with low or no income taxes have higher property or sales taxes.

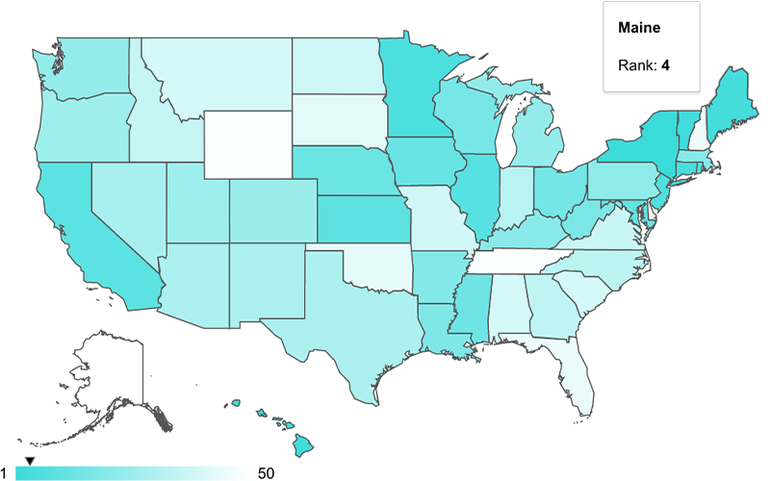

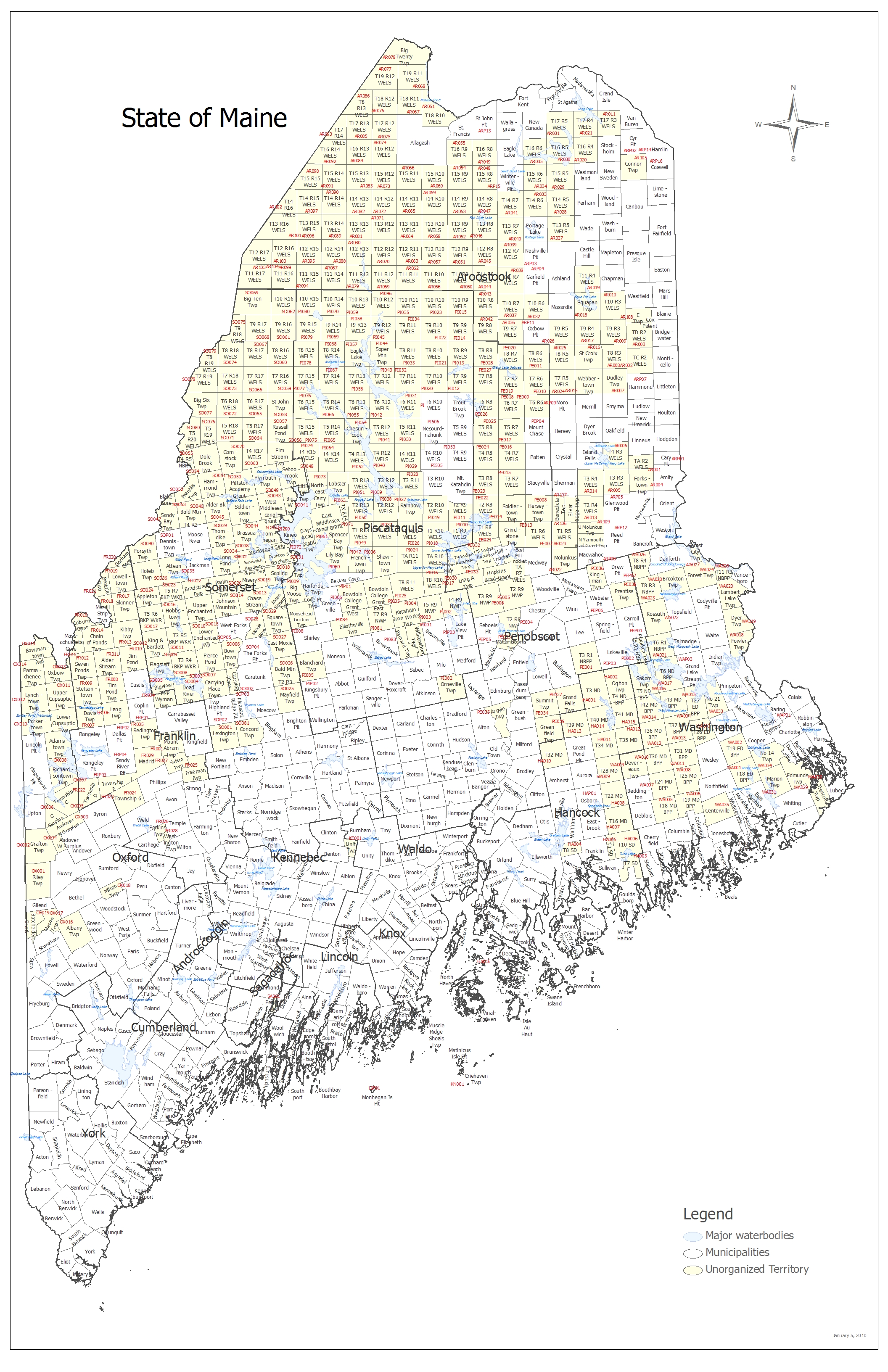

The additional amount is 3400 if the individual is both 65 or over and blind. Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes collected. Property taxes are also above average in Maine.

One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can be as high as 715. Reduced by social security received. Maine Tax Rates For Retirees at Tax Best Information Zone about Tips and References website.

You will also love that no additional city or county rates are collected on top of Maines sales tax rate. 8 on first 3 million above the threshold. This change started rolling out in.

Military retirement pay is exempt from taxes beginning Jan. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year. Maines income tax rate ranges from 58 to a top marginal rate of 715.

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. Deduct up to 10000 of pension and annuity income. In maine teachers are a part of the maine public employee retirement system which includes not only teachers but all state employees.

Retirement income tax breaks start at age 55 and increase at age 65. If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation. The exemption increase will take place starting in January 2021.

In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a refund of contributions in the prior calendar year. Current year 2021 forms and tax rate schedules These are forms and tax rate schedules due in 2022 for income earned in 2021. This is a SAMPLE onlyplease do.

And 12 on all remaining value. Discover Helpful Information and Resources on Taxes From AARP. MA pensions for those under the age of 65 qualify for the 4800 pension exemption.

Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year. As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees. Estates above that threshold are taxed as follows.

On the other hand if you earn more than 44000 up to 85 percent of your Social Security benefits may be taxed. As already mentioned Maine allows each of its pensioners to deduct 10000 in pension income. See image below at right.

However Maines sales tax rate is considerably low at 55. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes. Maine with a tax burden of just over 10 is the ninth highest in the country.

Increased the exemption on income from the state teachers retirement system from 25 to 50. Maine has three marginal tax brackets ranging from 58 the lowest maine tax bracket to 715 the highest maine tax bracket. For state income taxes virginia doesnt tax social security.

Maine tax laws conform with federal laws except in a few areas. Retirement income tax breaks start at age 55 and increase at age 65. Luckily while you have to watch out for the Maine state income tax your.

All residents over 65 are eligible for an income tax deduction of 15000 reduced by retirement income deduction. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Married filers that both receive pension income can exclude up to 20000.

Is my retirement income taxable to Maine. They also have higher than average property tax rates. Maine Estate Tax.

One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can be as high as 715. For deaths in 2021 the estate tax in Maine applies to taxable estates with a value over 587 million. 323 on all income but Social Security benefits arent taxed.

Average property tax 607 per 100000 of assessed value 2. The 10000 must be reduced by all taxable and nontaxable social security and railroad benefits. Less than 33650 58 of Maine taxable income 33650 but less than 79750 1952 plus 675 of excess over 33650 79750 or.

Maine tax rates for retirees. The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016. 29 on income over 440600 for single filers and married filers of joint returns 4 5.

Prior to January 1 2013 the graduated rates ranged from 2 to 85. According to the tax foundation a nonpartisan tax research group in washington dc these states and their top tax rates as of 2020 are. Payment Vouchers for the 2022 tax year.

Our system will base on the phrase Taxes In Maine For Retirees to give the most relevant results including event information that matches your search needs. Flat 463 income tax rate. Maine Income Taxes The state income tax in Maine is based on just three brackets.

If the taxable income is. The state is phasing in a military retirement income deduction over four years. With that being said the low cost of living may be less relevant depending on how much money you have for your retirement.

Although the good news is that Maine does not tax Social Security Income. Schedule 1 - Subtraction from Income Line 2d This is a manual entry in the tax software using the amount shown in Box 14. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000.

Ask Hannah Holmes How Does Being Two Blocks From A Cemetery Impact A Home S Value New Construction Victorian Homes Home

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Military Retirees Retirement Retired Military Military Retirement

Maine Income Tax Calculator Smartasset

Maine Sales Tax Small Business Guide Truic

Maine Income Tax Calculator Smartasset

Maine Retirement Tax Friendliness Smartasset

Maine Retirement Tax Friendliness Smartasset

Top Ten De Paises Ideales Para Vivir Retirement Planning Places To Go Travel Infographic

Maine Property Tax Rates By Town The Master List

Tax Maps And Valuation Listings Maine Revenue Services

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

York Maine States Preparedness

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Benefit Payment And Tax Information Mainepers

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Visualizing U S Stock Ownership Over Time 1965 2019 Investing Financial Wealth Chartered Financial Analyst